Services

Financing Solutions

Bank & non‑bank funding for projects, trade & growth.

Structured trade & project finance, supply‑chain finance, asset‑backed lending, pre‑payments, inventory & receivables facilities. We tap both bank and alternative capital providers to tailor cost‑effective funding.

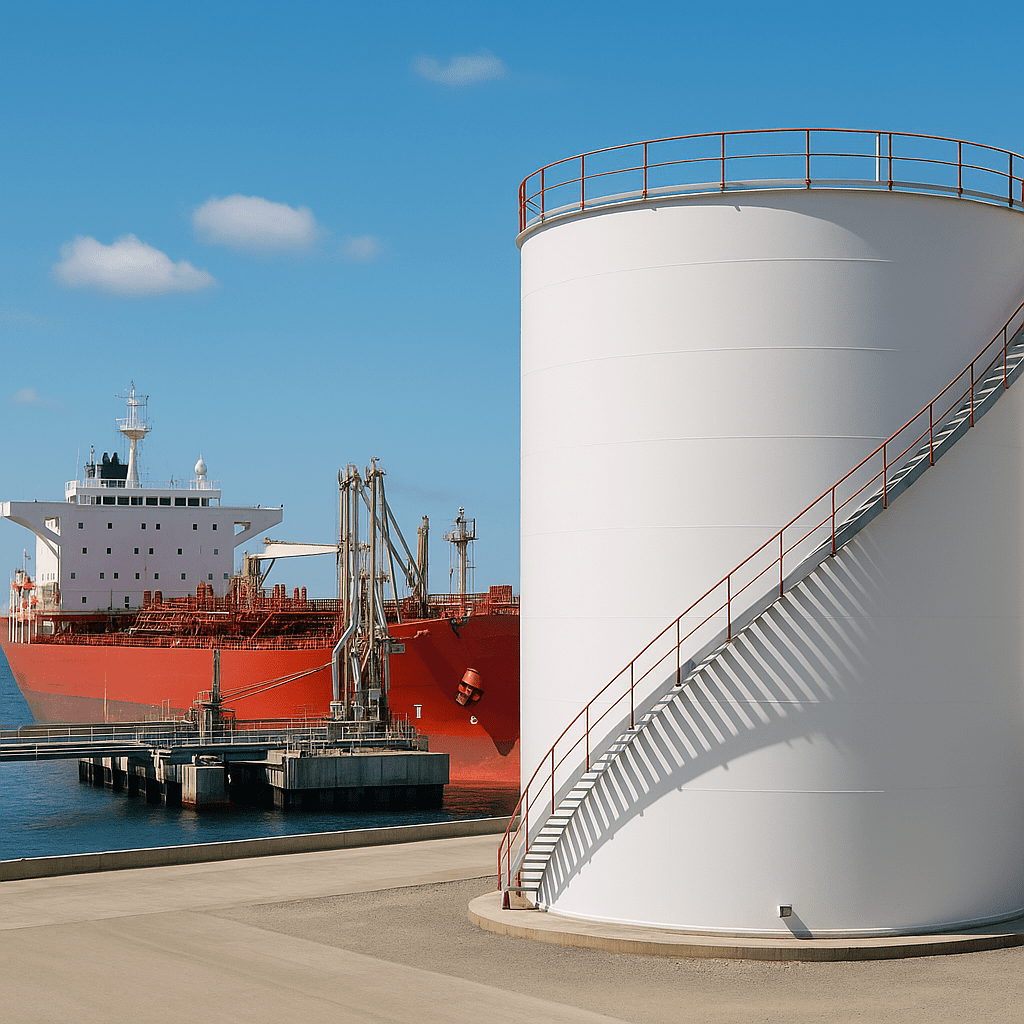

Oil & Gas

Bespoke supply agreements for refineries, producers & wholesale buyers.

We negotiate and structure tailored supply and purchase agreements linking refineries, upstream producers and large-volume wholesale customers — ensuring reliable flows of crude and refined products.

Singular Asset Transactions

We originate, structure, and execute off-market transactions involving high-value, strategically located assets. Our scope includes both acquisitions and divestitures, offering full-cycle support from sourcing and due diligence to structuring and closing.

We work across the following asset classes:

- Prime estates, land plots & urban development opportunities

– Including residential, mixed-use and hospitality-driven developments. - Hotels & resorts

– Operating or repositioning assets in key destinations, often with expansion or redevelopment potential. - Logistics hubs, warehouses & terminals

– Core or value-add assets linked to supply chain and last-mile distribution. - Ports & transport infrastructure

– Including strategic stakes or concession rights. - Energy infrastructure

– Pipelines, grids, storage and transition-related assets. - Data centres

– Operational or under development, with scalable capacity and institutional-grade demand.

We act on behalf of developers, family offices, funds, and institutional investors, ensuring discretion, alignment, and value creation at every step.

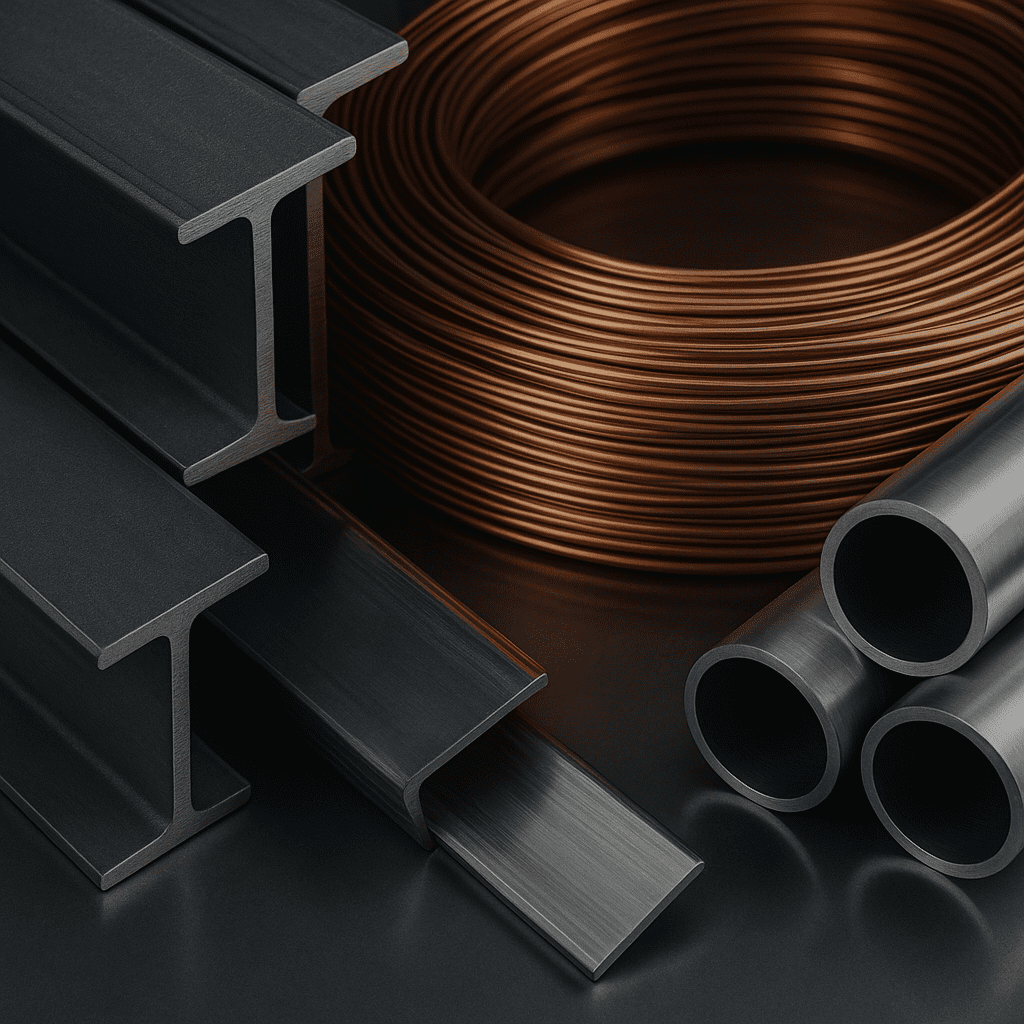

Commodities Trading

Metals: Steel, aluminium, copper, …

M&A Advisory

Discreet sourcing, valuation & negotiation.

Off‑market deal origination, strategic fit analysis, financial modelling, SPA negotiation and closing support.